지역센타회원 | 5 Ideas For $255 Payday Loans Online Same Day

아이디

패스워드

회사명

담당자번호

업태

종류

주소

전화번호

휴대폰

FAX

홈페이지 주소

PaydayChampion has been recognized as the top location to obtain a $255 loan. and for a cause. This company has been aiding those with poor credit scores for years. The company's reputation for innovation and quality is highly deserved. Despite their low credit ratings there are many who trust the lending platform. This says a lot about the business's reliability and reputation. The distinctness of this platform is in its willingness to work with Tribal lenders. This is a good sign of the brand's dedication and commitment to diversity. Be aware that because of Tribal regulations, working with Tribal lenders can cause an increase in cost and tax burdens. But, this doesn't hinder borrowers from taking advantage of Tribal Lenders services. PaydayChampion is able to help customers of all backgrounds to get loans without having to incur excessive fees since it is focused on its customers. Features 1. Extra services PaydayChampion will assist you even when it appears unlikely that the loan you've applied for will not be approved. In order to provide you with the highest quality service and speed up the cash application, they might suggest other items. If you are facing financial hardships, services such payday loans and credit rehabilitation as well as personal loans and debt relief are extremely helpful. 2. It's easy to apply PaydayChampion has developed the art of time management to meet one of its principal goals. Getting a $255 payday loan is now accessible through our simple application process so you can apply now and receive your funds on the table by tomorrow. PaydayChampion has a simple 3-step procedure for applying for a loan. Visit the PaydayChampion Website to start. It is possible to access the application online on that site. It's easy to fill out to get in touch and request an advance loan. You can apply for loans quickly and easily from any place and time that you prefer. Once lenders have received the application, they'll review it, and loan offers will be made in the event that you meet their requirements. It is crucial to compare all offers and decide the one that best suits your needs. If you accept the offer, there may be further negotiations with the lender. Once the terms have been reached between you and your lender, the money will be transferred to your account in minutes or less. 3. The basis of the criteria This loan agency can assist those with bad credit because they have simplified the qualification criteria. With a minimum amount of $255, almost anyone with significant financial difficulties can qualify for the loan and get the money they need in a short amount of time. Below are the minimum requirements that must be met. Please provide your complete name, address as well as email addresses. Additionally, you must be a permanent US resident and at least 18-years old. For a third, an individual checking account is required. Last but not least you'll need to present proof of your reliable income. Pros Rapid response Secure online loans service Installment loans Instantaneous deposit of funds Indigenous communities are eligible for loans from money lenders There are no additional costs or taxes. Log in online to get easy access Prerequisites for Application Cons PaydayChampion is not available outside of the United States. Tribal lenders could be able to charge higher fees or tax rates. Customer reviews We were amazed at how many people have come back to PaydayChampion after reading their reviews. PaydayChampion has been a great help to those in necessity and offered the financial resources and cash they required. Many of the borrowers were satisfied by the speed at which they received offers for loans after the application procedure. 3. RixLoans is a Reliable Loan Marketplace that Offers the lowest rates of interest RixLoans (now 2022) was launched in the year 2015 as Bridgepayday. It has maintained the highest standards one would expect of an outstanding loan website. RixLoans was the initial lending platform borrowers have turned to for over two years. This is because of RixLoans its admirable goal to assist people in financial hardship without forcing them into taking loans they do not need or want. As growing numbers of people test and recommend this lender to their close friends and families, RixLoans's client base has covered the whole United States. RixLoans helps you to find the perfect lender to match your needs thanks its extensive lender network. RixLoans is a trusted resource which can connect you to these lenders, not just one of their own. Features 1. Large lender network RixLoans has created a massive network to lend money to as many people as possible. The chances of your application being rejected are lower to be rejected because of their large network. They also have access to other lenders to provide a solution if their immediate lenders aren't able to fulfill your requirements. But RixLoans will provide you with additional services relating to your financial situation even in the event that your application is denied. These services are beneficial and ensure that users are happy and content. Therefore, this platform utilizes all resources available to ensure the satisfaction of its customers. 2. Take care of the customer experience RixLoans places a high priority in making sure that customers feel heard. Because every customer is unique the company has an in-house team of customer service and educational tools. This allowed them to direct their customers towards the best choices for financing. RixLoans are not able to have an impact on the terms or rates charged by lenders. This is why it is advised to go through each offer carefully before making your final choice. 3. The application process RixLoansThe three-step process for applying is created to be easy and fast, which is in line with the brand's reputation of speed. This method ensures that funds can be obtained in just a few minutes. RixLoans services are available for at any time, anywhere. For you to get started you must follow the three steps of the RixLoans application procedure. Visit the RixLoans site. The application process is very simple and can be done within five minutes. The application form will require you to fill in basic details. The lender will then review it and confirm it once you have completed the online application. If everything goes well, you'll start receiving offers. After carefully reviewing each request, you can accept them if they match your expectations and requirements. Once the parties have reached an agreement to the terms, you are able to anticipate funds being transfered into your account on the same day. Pros Secure and secure platform Service is provided for free Convenient online application form Wide lender network Experience gained over many years in the field of professional experience Excellent reviews Application method that is quick, three steps Stellar customer care service Reliable Offers Cons RixLoans Services aren't available outside of the U.S. Customer reviews The expertise of the team has been rewarded with numerous compliments after having read many customer reviews. People were very satisfied about the way that the platform handled cases and also its lenders offer attractive terms and conditions. Another benefit is that the speedy application process can make thousands of people be amazed. Customers have reported feeling 100% secure by using RixLoans and filling in their personal details on RixLoans.

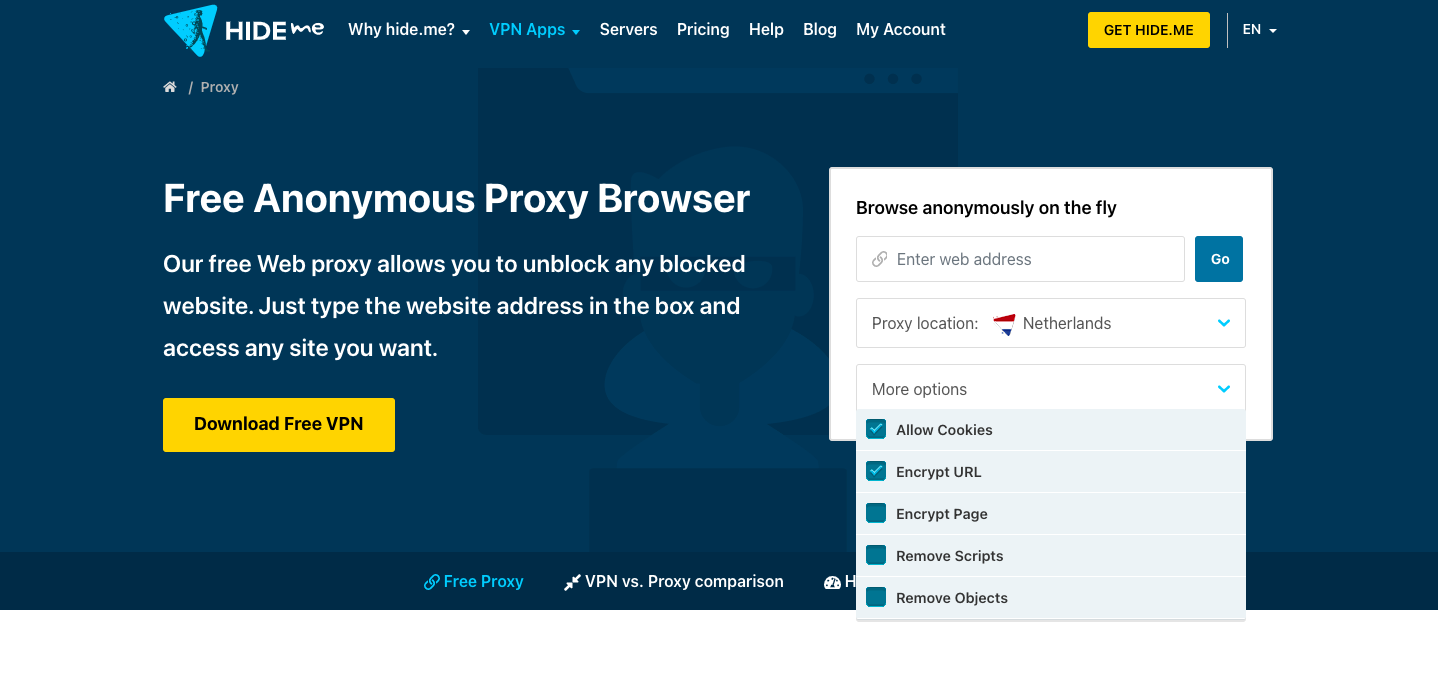

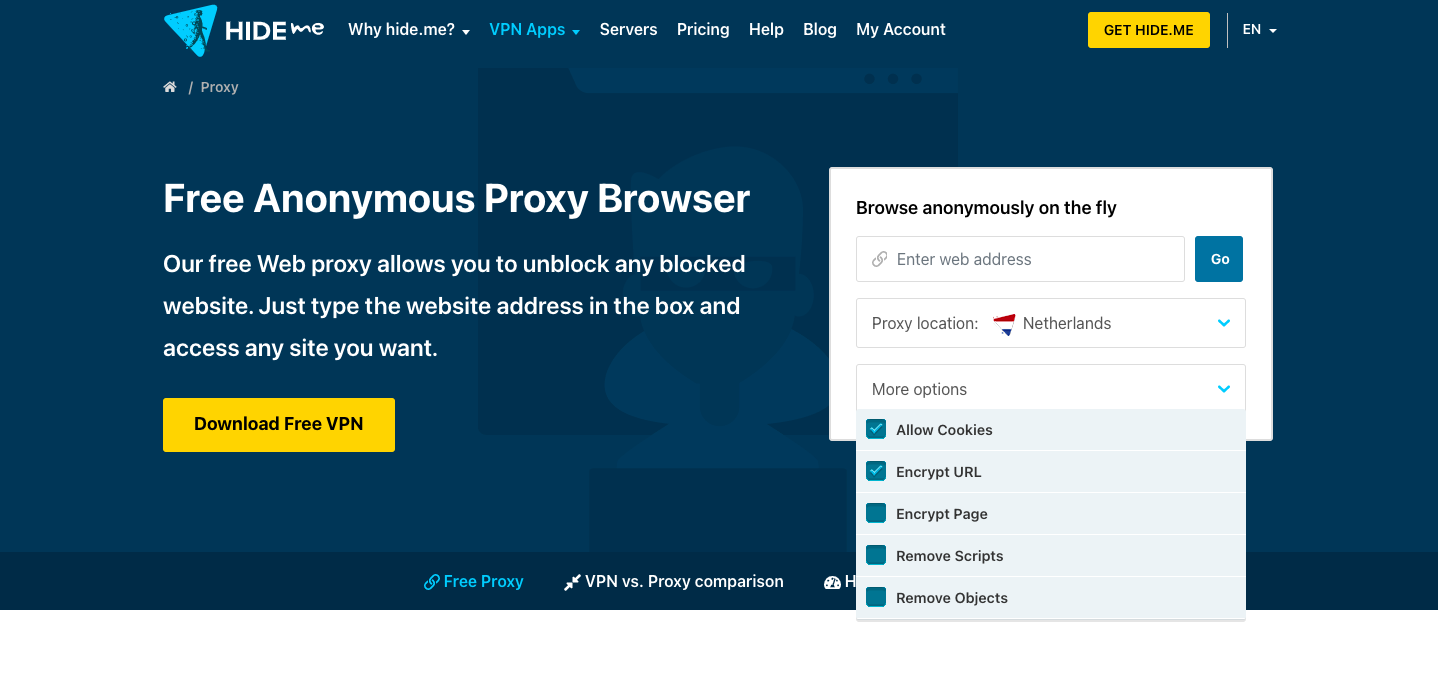

If you loved this information and you would love to receive much more information with regards to Proxy Sites, ri.kfupm.edu.sa, kindly visit the site.

If you loved this information and you would love to receive much more information with regards to Proxy Sites, ri.kfupm.edu.sa, kindly visit the site.

If you loved this information and you would love to receive much more information with regards to Proxy Sites, ri.kfupm.edu.sa, kindly visit the site.

If you loved this information and you would love to receive much more information with regards to Proxy Sites, ri.kfupm.edu.sa, kindly visit the site.